Losses from cryptocurrency-related investment fraud schemes reported have risen to $3.96 billion in 2023 from $2.57 billion in 2022, an increase of 53%. This type of fraud has emerged as the biggest crypto fraud in the last year, as per the FBI. While individuals in the age ranges of 30 – 39 and 40 – 49 filed the most cryptocurrency-investment fraud complaints (approximately 5,200 reports in each age group), complainants over the age of 60 reported the highest losses (over $1.24 billion), as per the Internet Crime Complaint Report prepared by the FBI.

According to the report published on Monday, investment fraud was the most pervasive – and expensive – type of crypto-related fraud in 2023. Of the more than 69,000 reports of crypto-related crime the agency received last year, nearly half were reports of investment fraud, and investment fraudsters made off with a whopping $4 billion.

While crypto crimes only made up about 10% of the complaints the FBI received, the $5.6 billion figure was roughly half the overall loss by complainants.

Investment fraud generally involves a deceptive practice to induce investment based on false information. These schemes offer individuals large returns with the promise of minimal risk. Over the years, cryptocurrency’s widespread promotion as an investment vehicle, combined with a mindset associated with the “fear of missing out,” has led to opportunities for criminals to target consumers and retail investors—particularly those who seek to profit from investing but are unfamiliar with the technology and the attendant risks.

In 2023, the most prominent type of crypto-related investment fraud was what the FBI described as “confidence-enabled” schemes, which takes place over long periods of time as scammers form relationships with their victims, usually over messaging apps, before encouraging them to invest huge amounts of money in fraudulent cryptocurrency platforms that they are unable to withdraw from.

The cryptocurrency investment fraud involves a trust-based social engineering approach. Here’s a breakdown of the key steps:

- Target Selection: Criminals identify potential victims on dating apps, social media, professional networking sites, or encrypted messaging apps.

- Building Trust: They establish relationships with their targets to gain their trust and confidence.

- Introducing Cryptocurrency: Once trust is established, the criminals introduce the topic of cryptocurrency investment, claiming expertise or knowledge of potential opportunities.

- Fake Platforms: Victims are directed to fraudulent websites or apps controlled by the scammers.

- Investment Guidance: Criminals coach victims through the investment process, showing them fabricated profits to build trust.

- Withholding Funds: After victims invest larger amounts, scammers demand additional fees or taxes to prevent withdrawals.

- Ultimately, victims are unable to recover their funds.

” Criminals may allow victims to withdraw small amounts early in the scam to engender more trust in the fraudulent platforms. Nevertheless, when the targets attempt to fully withdraw their investment and any purported earnings, they are told they need to pay a fee or taxes. The criminals never release the bulk of funds, even if their targets pay the imposed fees or taxes. Individuals who report losing money to these schemes are sometimes also targeted by fraudulent businesses that claim to help recover lost cryptocurrency funds,” the FBI said in its report.

Representatives from these fraudulent businesses claim to provide cryptocurrency tracing and promise an ability to recover lost funds. They contact individuals who have lost money via social media or messaging platforms or advertise their fraudulent cryptocurrency recovery services in the comment sections of online news articles and videos about cryptocurrency; among online search results for cryptocurrency; or on social media.

Fraudulent businesses claiming to recover stolen funds charge an up-front fee and either cease communication after receiving an initial deposit or produce an incomplete or inaccurate tracing report and request additional fees to recover funds. These fraudulent companies may claim affiliation with law enforcement or legal services to appear legitimate.

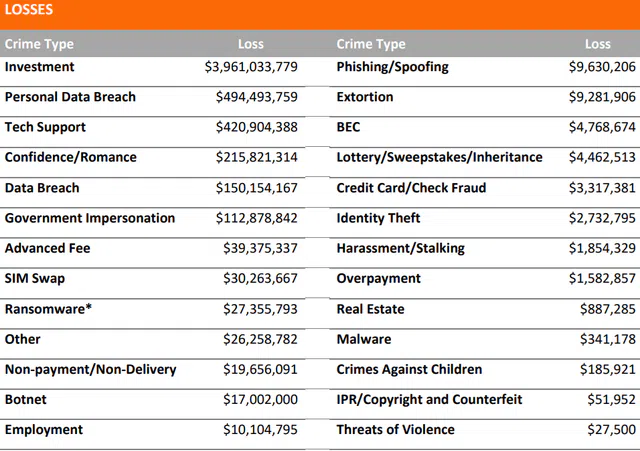

2023 CRIME TYPES WITH CRYPTOCURRENCY NEXUS

)

Human trafficking nexus

A 2022 investigation by ProPublica found that many crypto investment scammers are human trafficking victims held by ‘pig butchering gangs’ across Southeast Asia and forced to carry out scamming operations.

Addressing the Threat:

The FBI warns investors to be cautious of unsolicited investment offers, especially those related to cryptocurrency. It is essential to verify the legitimacy of platforms and conduct thorough research before making any investments. Additionally, individuals who believe they have been victims of cryptocurrency scams should report the incident to the appropriate authorities.

First Published: Sep 10 2024 | 3:17 PM IST

Note:- (Not all news on the site expresses the point of view of the site, but we transmit this news automatically and translate it through programmatic technology on the site and not from a human editor. The content is auto-generated from a syndicated feed.))