)

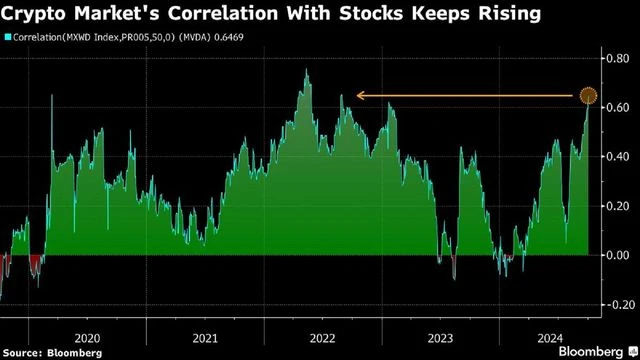

A 50-day correlation coefficient for a gauge of the top 100 digital tokens and MSCI Inc.’s global equity index is at 0.65. | Photo: Shutterstock

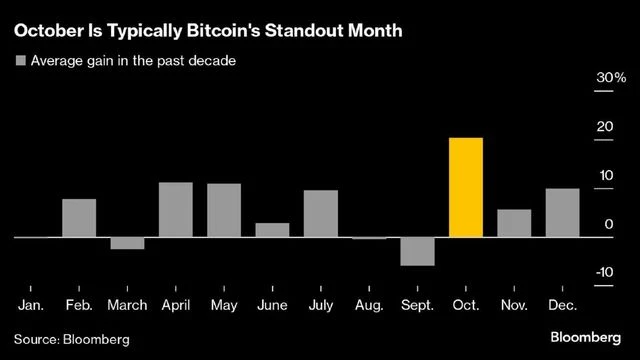

Bitcoin speculators banking on a seasonal October melt-up faced an early reality check as deepening tension in the Middle East spurred a bout of caution across global markets.

The digital asset fell 4.7 per cent on Tuesday, the most in nearly a month, after Iran fired about 200 ballistic missiles at Israel in a sharp but brief escalation of hostilities between the two adversaries. The token pared some of the drop on Wednesday, changing hands at around $61,260 as of 7:43 a.m. in New York.

Click here to connect with us on WhatsApp

)

Sean McNulty, director of trading at liquidity provider Arbelos Markets, argued that the selloff is a “momentary setback” given that the Federal Reserve has begun cutting interest rates. The government that emerges after November’s US presidential election is also likely to be friendlier toward crypto, he said.

“The seasonal trend of October being the best month for Bitcoin is alive and well,” McNulty added.

)

Digital assets have moved more in tandem with stocks lately, indicating macroeconomic drivers like monetary policy are key for Bitcoin at the moment.

A 50-day correlation coefficient for a gauge of the top 100 digital tokens and MSCI Inc.’s global equity index is at 0.65, the highest since 2022, according to data compiled by Bloomberg. A reading of 1 indicates assets are moving in lockstep, while minus 1 signals an inverse tie.

“The geopolitical environment doesn’t look conducive to risk assets,” said Caroline Mauron, co-founder of Orbit Markets, a provider of liquidity for trading in digital-asset derivatives.

First Published: Oct 02 2024 | 11:43 PM IST

Note:- (Not all news on the site expresses the point of view of the site, but we transmit this news automatically and translate it through programmatic technology on the site and not from a human editor. The content is auto-generated from a syndicated feed.))