)

Unlike the Bitcoin portfolios, a group of US spot-Ether ETFs suffered a net outflow on Aug. 23. | Photo: Bloomberg

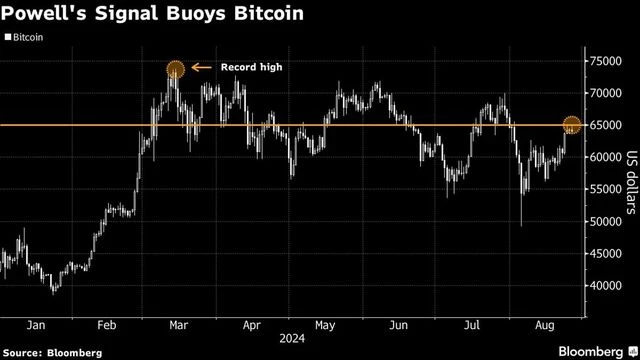

Bitcoin touched $65,000 for the first time in about three weeks, aided by reviving demand for dedicated US exchange-traded funds amid signs that the Federal Reserve is set to loosen monetary policy.

Fed Chair Jerome Powell on Friday gave the clearest indication yet that the central bank is on course to cut benchmark rates from a more than two-decade high, portending a more favorable liquidity backdrop for global markets.

)

Powell’s signal spurred a $252 million net inflow — the highest in more than a month — into a group of one dozen US spot-Bitcoin ETFs the same day, data compiled by Bloomberg show. The funds have attracted inflows for seven straight days. Investment products holding Ether saw $36 million in net outflows last week, according to data compiled by CoinShares.

Unlike the Bitcoin portfolios, a group of US spot-Ether ETFs suffered a net outflow on Aug. 23. Ether was on the back foot on Monday, dropping as much as 2.1 per cent. Other major tokens were little changed.

Toncoin, a token from a blockchain linked to messaging app Telegram, nursed losses after the latter’s co-founder Pavel Durov was detained in France.

First Published: Aug 26 2024 | 7:43 PM IST

Note:- (Not all news on the site expresses the point of view of the site, but we transmit this news automatically and translate it through programmatic technology on the site and not from a human editor. The content is auto-generated from a syndicated feed.))