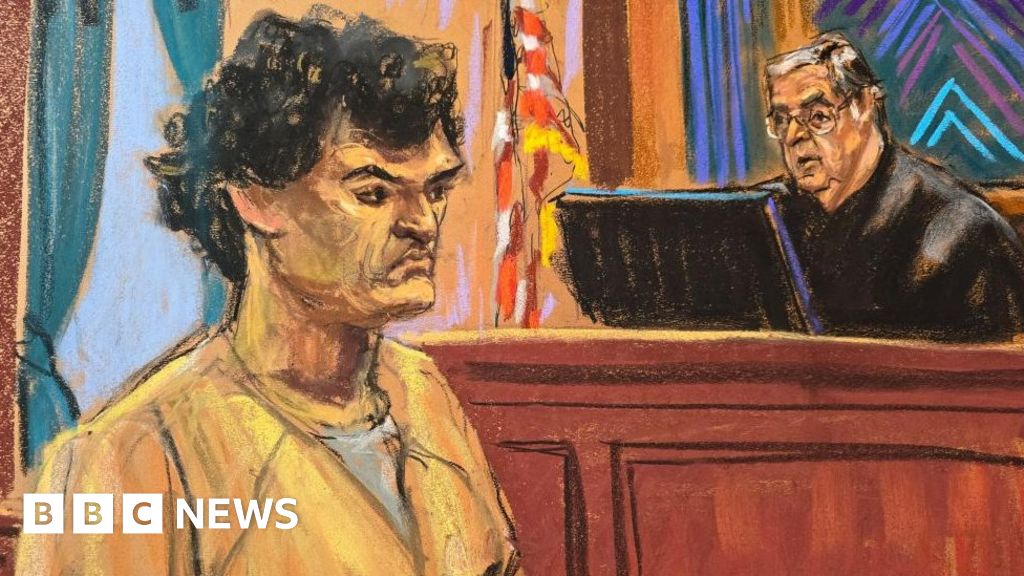

Sam Bankman-Fried, co-founder of the failed crypto exchange FTX, has been sentenced to 25 years in prison for defrauding customers and investors of his now-bankrupt firm.

The ruling cements the downfall of the former billionaire, who emerged as a high profile champion of crypto before his firm’s dramatic collapse in 2022.

He was found to have stolen billions from customers ahead of the failure.

He was found to have stolen billions from customers ahead of the failure.

“I’m sorry about that. I’m sorry about what happened at every stage,” he said, speaking quietly and clearly ahead of his sentencing.

FTX was one of the world’s largest crypto exchanges before its demise, turning Bankman-Fried into a business celebrity and attracting millions of customers who used the platform to buy and trade cryptocurrency.

Rumours of financial trouble sparked a run on deposits in 2022, precipitating the firm’s implosion and exposing Bankman-Fried’s crimes.

He was convicted by a New York jury last year on charges including wire fraud and conspiracy to commit money laundering, after a trial that detailed how he had taken more than $8bn (£6.3bn) from customers, and used the money to buy property, make political donations and put toward other investments.

Before reading the sentence on Thursday, Judge Lewis Kaplan provided a harsh assessment of Bankman-Fried’s behaviour, saying he had lied during his testimony at trial when he claimed he was unaware until the last minute that his companies were taking money entrusted to them for safe-keeping by customers and using it for other purposes.

Sam Bankman-Fried, co-founder of the failed crypto exchange FTX, has been sentenced to 25 years in prison for defrauding customers and investors of his now-bankrupt firm.

He was found to have stolen billions from customers ahead of the failure.

The ruling cements the downfall of the former billionaire, who emerged as a high profile champion of crypto before his firm’s dramatic collapse in 2022.

“I’m sorry about that. I’m sorry about what happened at every stage,” he said, speaking quietly and clearly ahead of his sentencing.

He was found to have stolen billions from customers ahead of the failure.

He was found to have stolen billions from customers ahead of the failure.

“I’m sorry about that. I’m sorry about what happened at every stage,” he said, speaking quietly and clearly ahead of his sentencing.

FTX was one of the world’s largest crypto exchanges before its demise, turning Bankman-Fried into a business celebrity and attracting millions of customers who used the platform to buy and trade cryptocurrency.

Rumours of financial trouble sparked a run on deposits in 2022, precipitating the firm’s implosion and exposing Bankman-Fried’s crimes.

He was convicted by a New York jury last year on charges including wire fraud and conspiracy to commit money laundering, after a trial that detailed how he had taken more than $8bn (£6.3bn) from customers, and used the money to buy property, make political donations and put toward other investments.

Before reading the sentence on Thursday, Judge Lewis Kaplan provided a harsh assessment of Bankman-Fried’s behaviour, saying he had lied during his testimony at trial when he claimed he was unaware until the last minute that his companies were taking money entrusted to them for safe-keeping by customers and using it for other purposes.

#FTX039s #Sam #BankmanFried #sentenced #years

Note:- (Not all news on the site expresses the point of view of the site, but we transmit this news automatically and translate it through programmatic technology on the site and not from a human editor. The content is auto-generated from a syndicated feed.))