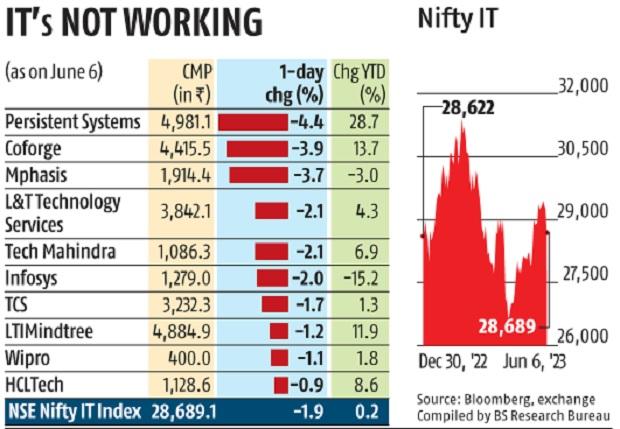

As a result, the Nifty IT index closed at 28,689 points on Tuesday, with a decline of 550 points, or 1.9 per cent — the most since April 17. By comparison, the Nifty50 index rose by 5 points or 0.03 per cent.

The selling in IT shares came after EPAM cut its revenue growth outlook for 2023 by 5 per cent as the company expects a recovery in discretionary spending to take between two and four quarters.

“We expect revenues in Q1FY24E (estimates for the first quarter of the 2023-24 financial year) to be weaker than Q4FY23 across companies in our coverage universe. We believe that the demand environment is especially weak in the financial services and technology segments,” said a note by Kotak Institutional Equities (KIE).

“Noting the weak demand, we are surprised by the rally in stock prices across our coverage in the past month. We believe that upsides exist in Infosys and HCL Tech but are wary of other names,” the note said.

The sell-off was triggered by weak results and guidance by Infosys amid a banking crisis in the US and Europe. However, buying interest once again emerged in IT stocks amid a rally in the US’s Nasdaq index. However, EPAM’s move to lower its full-year earnings and revenue guidance has once again clouded the outlook.

The note by KIE said Indian IT has a more balanced discretionary and maintenance spending portfolio.

Note:- (Not all news on the site expresses the point of view of the site, but we transmit this news automatically and translate it through programmatic technology on the site and not from a human editor. The content is auto-generated from a syndicated feed.))