Shares of FSN E-Commerce Ventures, which owns beauty e-retailer Nykaa, tumbled 7 per cent to Rs 166.85 on the BSE in Thursday’s intra-day trade on the back of heavy volumes as the one-year lock-up period on pre-initial public offering (IPO) investors ended. At 09:22 AM, around 15.68 million equity shares changed hands on the counter on the BSE, the exchange data shows.

The stock has also turned ex-bonus today, for its 5:1 bonus share issue i.e. five bonus shares for every one share held in the company. The board of the company had fixed Friday, November 11, 2022 as the ‘Record Date’ for the purpose of determining the members eligible for bonus equity shares.

At 10:02 am, Nykaa was trading 4 per cent lower at Rs 171.90, as compared to 0.71 per cent decline in the S&P BSE Sensex. A combined 57.35 million equity shares have changed hands on the NSE and BSE so far in trades. The names of the buyers and sellers could not be ascertained immediately.

In the past one month, the stock has declined 20 per cent, as compared to 4.5 per cent rise in the S&P BSE Sensex. It was quoting close to its all-time low price of Rs 162.91 (adjusted to bonus shares), touched on October 28, 2022.

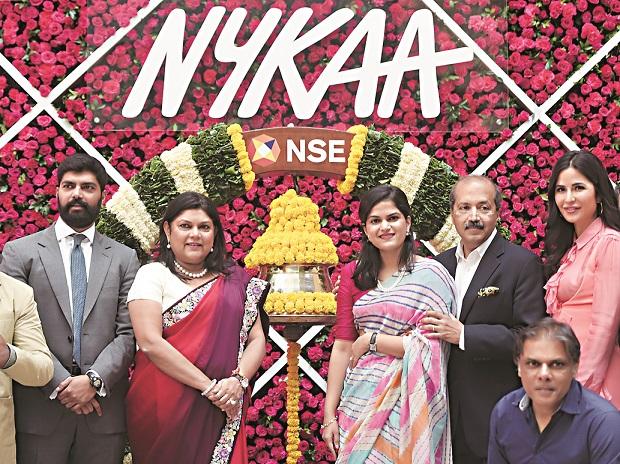

FSN E-Commerce Ventures, more commonly known as Nykaa, is a consumer technology platform, delivering a content-led, lifestyle retail experience to consumers through its diverse portfolio of beauty, personal care & fashion products including their own brand products.

Note:- (Not all news on the site expresses the point of view of the site, but we transmit this news automatically and translate it through programmatic technology on the site and not from a human editor. The content is auto-generated from a syndicated feed.))

buy viagra online

Hi there! Someone in my Myspace group shared this site with us so

I came to take a look. I’m definitely enjoying the information. I’m book-marking and will

be tweeting this to my followers! Exceptional blog and

wonderful design and style.

https://w3.livesingapore.club/

bokep indoh