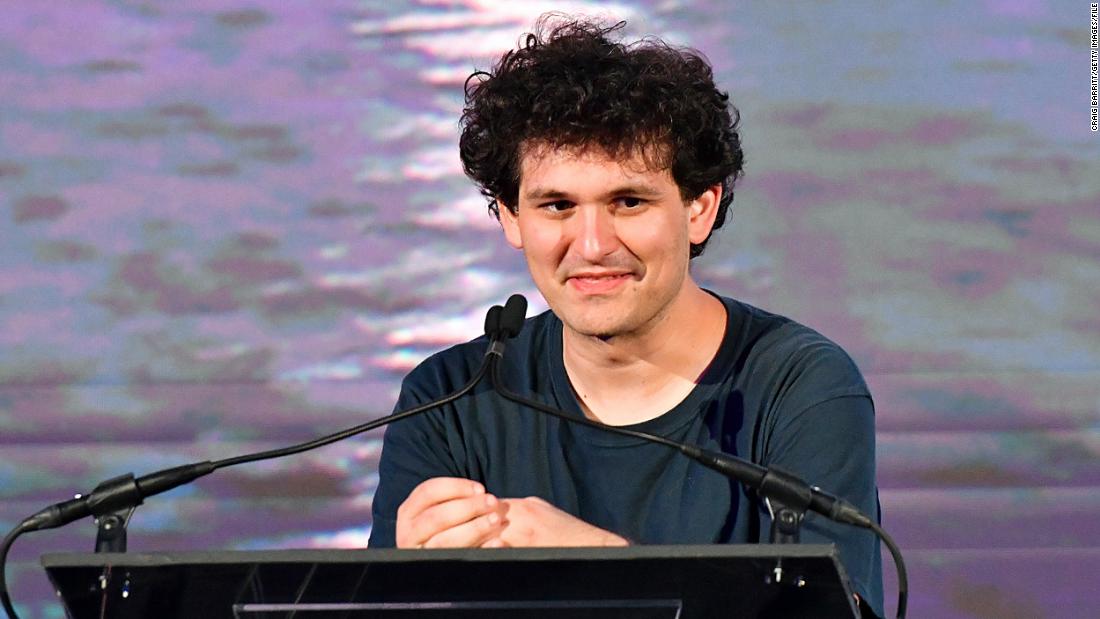

The SEC says former Founder and CEO of FTX Sam Bankman-Fried internally directed software code to be written in a way that allowed his crypto hedge fund, Alameda, to function with a negative balance in its the customer account at FTX.

This allegedly happened in August of 2019, just about four months after operations at FTX began.

This effectively gave the sister trading firm, Alameda, a limitless line of credit funded by customer assets, according to the Securities and Exchange Commission complaint filed in federal court Tuesday.

That meant there was no meaningful distinction between FTX customer funds and Alameda’s funds that Bankman-Fried used as his “personal piggy bank,” the complaint says. He hid from investors and customers that he used the funds to buy luxury condos, support political campaigns, and make private investments, according to the SEC.

Between March 2020 and September 2022, Bankman-Fried executed loans from Alameda totaling more than $1.338 billion, including two instances in which Bankman-Fried was both the borrower in his individual capacity and the lender in his capacity as CEO of Alameda, the SEC says in its civil complaint.

Bankman-Fried used funds from Alameda to purchase tens of millions of dollars in Bahamian real estate for himself, his parents, and other FTX executives, according to the filing.

Alameda co-founders Nishad Singh and Gary Wang also borrowed $554 million and $224.7 million, respectively, by similarly executing promissory notes with Alameda in 2021 and 2022, the filing says.

Singh and Wang have not been charged with any crimes at this point.

The loans to Bankman-Fried and others were “poorly documented, and at times not documented at all,” the lawsuit says.

When prices of crypto assets plummeted in May 2022, Bankman-Fried paid back Alameda’s demanding third-party lenders from its FTX “line of credit,” further growing the multi-billion-dollar liability and then concealed it in the Alameda balance sheet to avoid alarming investors, the complaint alleges.

The FTX chief executive continued to leverage the companies for his personal benefit, loaning himself $136 million in late July 2022 – one month after offering crypto financial services company BlockFi a $250 million revolving line of credit to ease its own liquidity issues, according to the filing. Meanwhile, throughout the summer, he presented a “false and misleading positive account” of the company to investors, despite its “tenuous financial condition”, the SEC alleges.

Note:- (Not all news on the site expresses the point of view of the site, but we transmit this news automatically and translate it through programmatic technology on the site and not from a human editor. The content is auto-generated from a syndicated feed.))