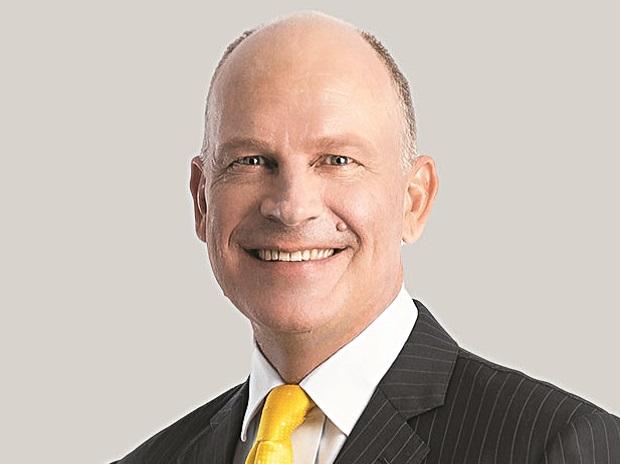

After his sudden return from the International Monetary Funds’ (IMF) meeting in Washington DC on Friday, the UK’s chancellor of the exchequer, Kwasi Kwarteng, has reportedly been sacked by Prime Minister Liz Truss. This makes Kwarteng the shortest-serving chancellor since 1970. The chancellor of the exchequer is the UK equivalent of India’s finance minister.

Kwarteng confirmed the development.

“You have asked me to stand aside as your chancellor. I have accepted,” he wrote in a letter to Truss.

According to a report by The Guardian, Truss was supposed to meet Kwarteng for “crisis talks” in Downing Street. She will scrap parts of their economic package announced in September.

Truss will conduct a press conference later on Friday.

On September 23, Truss announced corporation tax cuts worth 18 billion pounds. Her then finance minister, Kwarteng, had also planned to cancel a proposed increase in corporation tax from 19 to 25 per cent scheduled for April 2023.

In total, what was being deemed as Kwarteng’s “mini-budget” was expected to provide reliefs worth GBP43 billion based on tax cuts to shake the economy out of a slowdown.

According to Financial Times (FT), the “mini-budget” was “very much Truss’s policies and featured prominently in her Tory leadership campaign.”

However, tax cuts led to market chaos in the UK. The share market dipped and the returns on government bonds, called gilts in the UK, soared so fast that insurance products started demanding a “huge amount of cash”. The cost of borrowing and mortgage also surged.

The UK’s central bank, the Bank of England, had to start an emergency bond-buying programme to shore up gilt-exposed pension funds.

With the rising political and economic pressure, reports emerged from the UK that Truss might be planning a U-turn on her “mini-budget”.

Her move to sack Kwarteng is seen as a way to calm down the markets.

The Guardian reported, “The prime minister intended to get Kwarteng to ‘carry the can’ over her climbdown as she sought to calm the markets and the nerves of jittery Tory MPs.”

Kwarteng and Truss had different views regarding how much the earlier announced policies should be reversed.

Kwarteng recently said that he was “absolutely, 100 per cent” confident that he would be in post in November, despite the rebellion.

However, if the U-turn is not announced soon, the markets may react badly.

Credit Suisse economist Sonali Punhani said markets needed to see a credible fiscal plan, according to Moneycontrol.

“It would be challenging to deliver the scale of these cuts, but for them to be credible, these need to be delivered sooner rather than in the latter part of the forecast,” she said.

Note:- (Not all news on the site expresses the point of view of the site, but we transmit this news automatically and translate it through programmatic technology on the site and not from a human editor. The content is auto-generated from a syndicated feed.))

It is not my first time to pay a quick visit this website, i am browsing

this web page dailly and obtain fastidious data from here every

day.