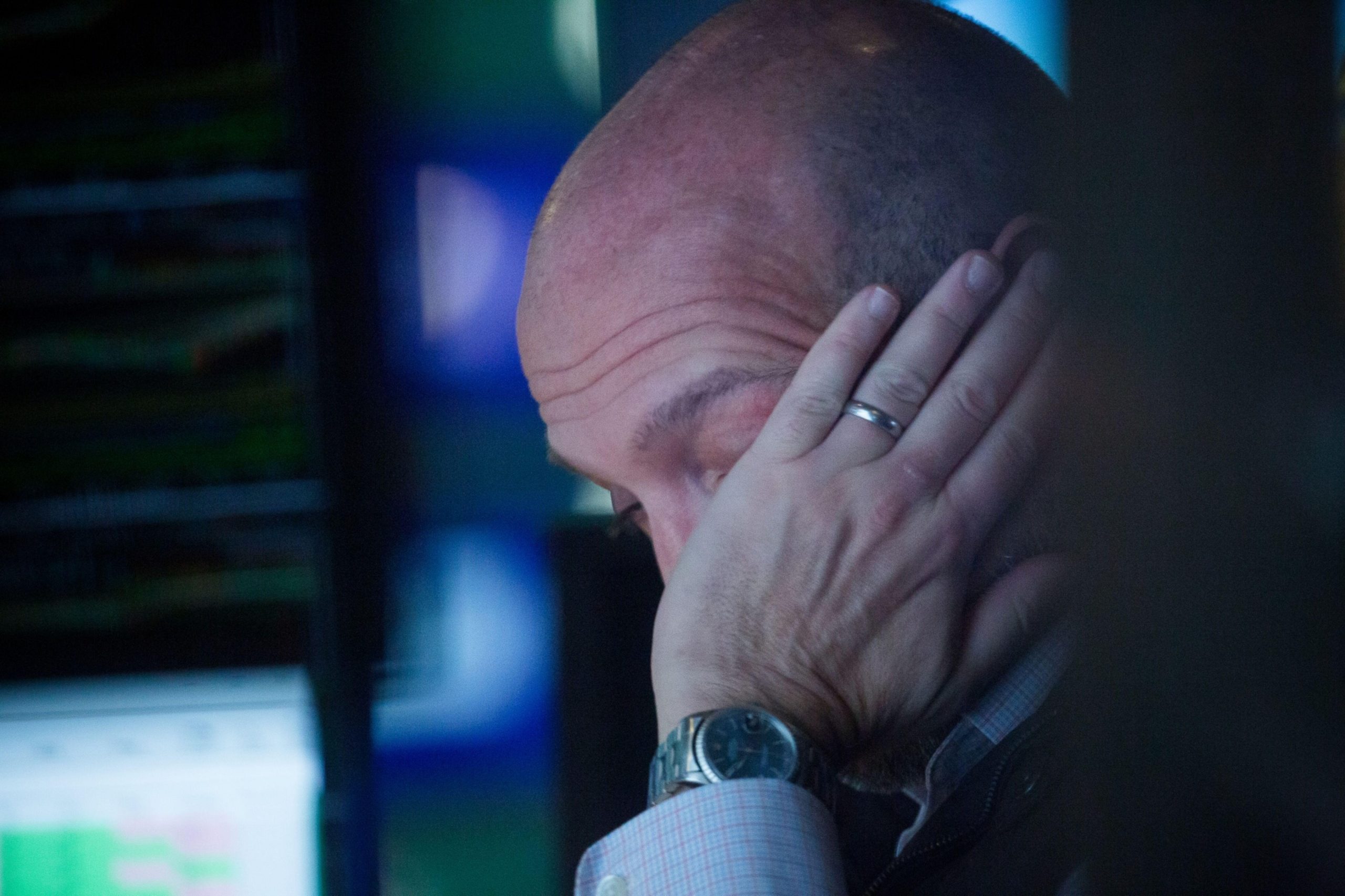

The risk of a US debt default is greater than it’s ever been, threatening to tip global markets into a brand-new world of pain. For investors, there are few places to hide other than the oldest hedge in the book: gold.

)

But it’s worth bearing in mind that even pessimistic analysts see bill holders getting paid— just late — and that in the case of the most fraught debt crisis in previous years, Treasuries rallied even as the US had its top credit rating removed by Standard & Poor’s.

Political and financial bigshots have been lining up to deliver warnings about what might happen if the debt-ceiling impasse isn’t resolved. “The whole world is in trouble,’’ said President Joe Biden. “Potentially catastrophic,’’ said JPMorgan Chase & Co. boss Jamie Dimon. “Very serious repercussions’’ was strong language by the International Monetary Fund’s guarded standards.

About 60% of MLIV Pulse respondents said the risks are bigger this time around than in 2011, the worst debt-limit crisis of the past. The cost of insuring against non-payment through one-year credit default swaps has surged well past levels seen in previous episodes, although they still suggest that the actual chance of a default is relatively slim.

The gold hedge doesn’t come cheap, as the metal has enjoyed a very good run so far this year. Buoyed first by the growing demand from Chinese luxury buyers, then by a crisis in the banking sector and the threat of US default, it’s currently loitering just shy of its all-time high of $2,075.47 an ounce.

In the meantime, the debt ceiling impasse has driven up the yield on some very short-dated securities that are seen as most at risk of a delayed payment, fueling distortions in the bills curve. The most elevated rates are those around early June, close to the point that Treasury Secretary Janet Yellen has warned the US might run out of borrowing headroom. If the department can make it past mid-June, then it’s likely to get a bit of breathing room from expected tax payments and other measures, before facing fresh challenges from late July, where market pricing also indicates a degree of strain and concern.

)

“If we do see a short period of default, the market reaction would put pressure on Congress to raise the debt ceiling,” said Priya Misra, head of rates strategy at TD Securities.

The risk of a pivot away from the greenback is something that investors are giving serious consideration. An earlier MLIV Pulse survey showed that a majority of respondents see the dollar making up less than half of global reserves within a decade.

–With assistance from Eddie van der Walt.

Note:- (Not all news on the site expresses the point of view of the site, but we transmit this news automatically and translate it through programmatic technology on the site and not from a human editor. The content is auto-generated from a syndicated feed.))