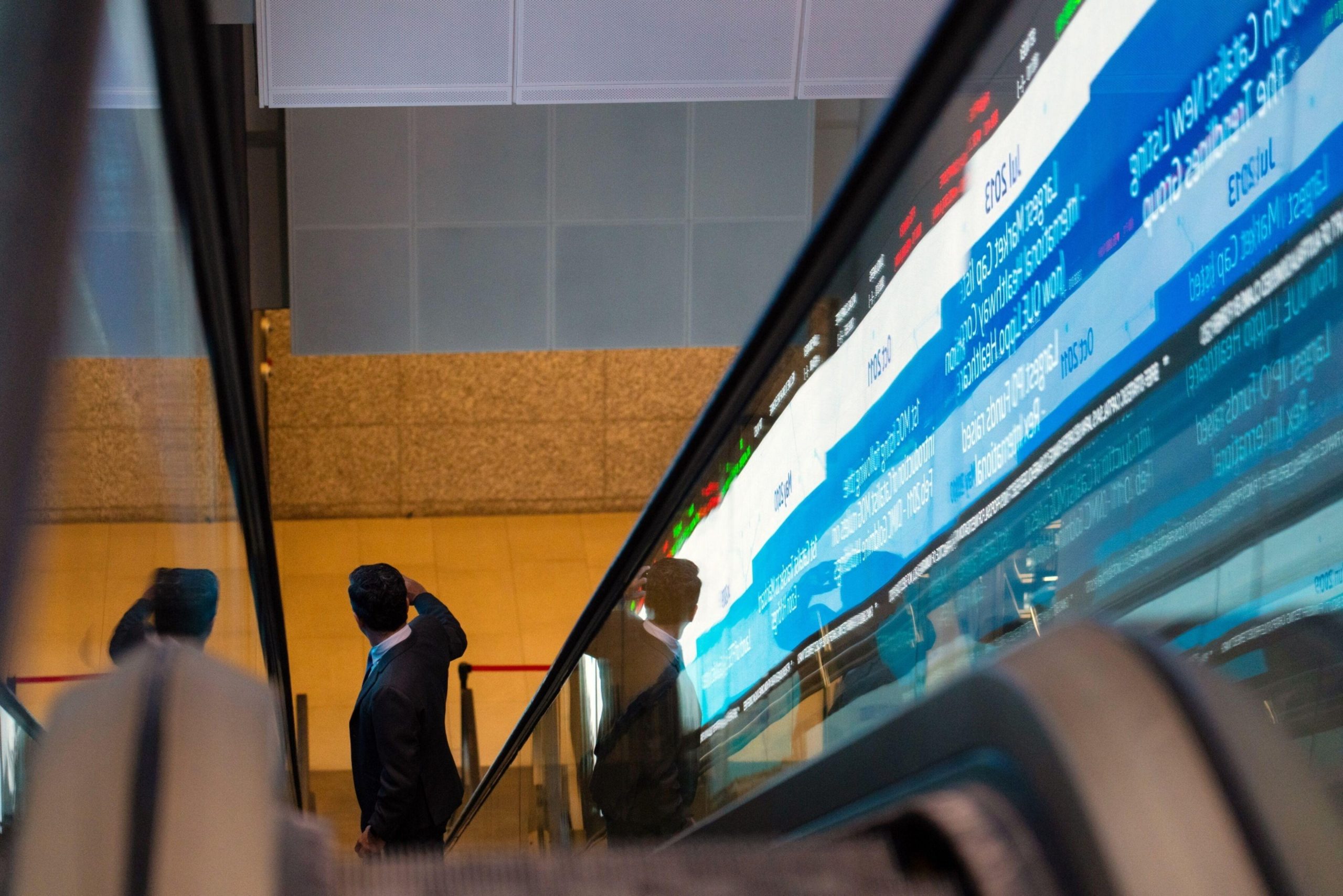

Indian equity benchmarks hit new highs on Thursday, propelled by gains in HDFC Bank and comments from US Federal Reserve Chair Jerome Powell. Powell’s statement, indicating a potential policy rate reduction later this year, provided crucial insights for investors, enhancing their awareness of market trends.

The S&P BSE Sensex and National Stock Exchange Nifty closed the session at new highs, with the Sensex reaching 74,228, a gain of 351 points, or 0.5 per cent, and the Nifty closing at 22,515, a gain of 80 points, or 0.4 per cent. Both indices surpassed their previous record close on March 7.

Besides the benchmark indices, the BSE 500, BSE AllCap, and the Nifty Midcap 100 made fresh record highs.

Most of the gains in the Sensex were contributed by HDFC Bank, which rose 3.06 per cent and was also the best-performing Sensex stock. The private lender’s shares rose after the bank reported a 26.4 per cent year-on-year deposit growth compared to the previous quarter when deposits grew by 7.5 per cent.

Hopes of better corporate results for the March quarter also lifted sentiment. Analysts said investors will keenly track the management commentary of firms in certain sectors.

“The fourth-quarter business updates from a few prominent companies were largely encouraging, driving stock-specific action in the market. Nifty has been consolidating in a narrow range at higher levels for the last few sessions, while broader markets have bounced back strongly, especially after a sharp recent correction,” said Siddhartha Khemka, head of retail research, Motilal Oswal Financial Services.

Investors interpreted Powell’s comments on Thursday as a reaffirmation that the central bank is on track to cut interest rates this year. The Fed chief said policymakers would wait for clearer signs of lower inflation before cutting interest rates, but the recent price bump did not alter their broader trajectory.

Powell said the recent macro numbers, though higher than expected, did not materially change the overall picture and reiterated that it would be appropriate to cut rates at some point this year.

Going forward, the Reserve Bank of India’s (RBI’s) monetary policy decision, March quarterly results, and US nonfarm payroll data on Friday will determine market trajectory.

The US private payroll data released on Thursday revealed that it rose to 184,000 in March against 155,000 in the previous month.

Vinod Nair, head of research at Geojit Financial Services, said investors expect RBI to keep the status quo amidst inflation worries.

Inflation worries have intensified amidst a rise in commodity prices. Brent crude on Thursday was trading at $90.4 per barrel after ending the previous day’s session at $90.6, the highest since October 2023.

“We expect some volatility on Friday, especially in the rate-sensitive sector, amid India’s central bank’s policy meeting. Overall, we maintain our positive bias on the market, and any dip can be viewed as a buying opportunity,” said Khemka.

The market breadth was positive, with 2,382 stocks advancing and 1,465 declining. After HDFC Bank, Tata Consultancy Services, which rose 1.4 per cent, gained the most, followed by Titan Company, which rose 1.9 per cent.

First Published: Apr 04 2024 | 8:19 PM IST

Note:- (Not all news on the site expresses the point of view of the site, but we transmit this news automatically and translate it through programmatic technology on the site and not from a human editor. The content is auto-generated from a syndicated feed.))