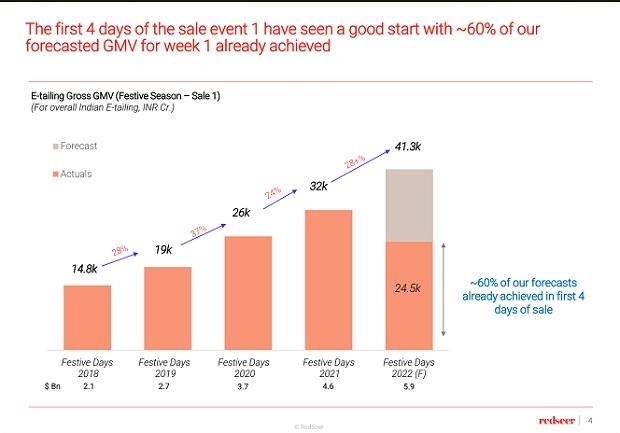

E-commerce retailers — led by Amazon and Flipkart — are on track to register sales worth $5.9 billion (Rs 41,000 crore), a 28 per cent increase over last year ($4.8 billion) during the first festive week. For the first four days (September 22–September 25), e-commerce platforms clocked sales of $3.5 billion (Rs 24,500 crore).

This contributed to about 60 per cent of the projected festive sale in the first week itself. It was mainly driven by smartphones, according to a report by consulting firm Redseer.

“This is 1.3x compared to the first four days in the previous year,” said Ujjwal Chaudhry, partner, Redseer Strategy Consultants.

It added, “The first four days of the previous year contributed around 59 per cent, signalling a better start to festive sales this year.”

Festive Event 1 is the first wave of festive sales, which includes Flipkart’s ‘The Big Billion Days (TBBD)’ and Amazon’s ‘Great Indian Festival’ (GIF). There are also Meesho’s ‘Mega Blockbuster Sale’ and sale events on platforms like Myntra, Reliance-owned Ajio and Nykaa.

The first four days of festive sales saw the overall daily average gross merchandise value (GMV) rise to 5.4x compared to business-as-usual days for online retail sales. An estimated 50-55 million shoppers made purchases during the first four days itself.

“Redseer had earlier projected a GMV of $5.9 billion (Rs 41,000 crore) for festive sale 1. As expected, we are on track to achieve this figure,” said Sanjay Kothari, associate partner, Redseer Strategy Consultants.

He added, “Around 60 per cent of our forecast is already achieved in the first four days of sale.”

Mobiles saw a 10x jump in terms of daily average GMV from business-as-usual days. For the first four days, an estimated Rs 11,000 crore worth of mobiles were sold from large e-commerce players.

In terms of units, 6-7 million mobile phones were sold during the first four days. Redseer is expecting a total sale of about 9-10 million units of mobiles for week 1.

Redseer said premium phones (iPhone 12, iPhone 13 and OnePlus) have driven mobile sales for the first four days. This category is driven by upgradation to new phones by customers and better offers across premium and mid-priced segments. Smartphones showed a growth of 1.2x during the first sale period. Redseer said e-commerce platforms along with their partners were able to bring the aspirational brands (Apple and OnePlus) to reasonable price-points. Owing to this, the average customers could afford them.

The platforms were running buy-now-pay-later options and offered further discounts through banking partnerships across high-end brands like Apple and Samsung.

“Sellers are more bullish, and hence, they are more aggressive in terms of discounts compared to last year,” said Chaudhry.

Premium phones like iPhone 13 were sold at discounted prices by various e-commerce platforms for as low as Rs 50,000 during Flipkart’s festive sale event.

However, the internet was abuzz with complaints of several consumers, who claimed that their iPhone 13 orders reportedly got cancelled.

“With so many new sellers coming to the platform, it’s fair to assume that there are going to be some teething issues,” said Chaudhry.

“This is just a scale shift, like almost 700,000 sellers coming online at the same time. We believe it’s a part of the journey and we have seen those shifts happening in the past as well.”

Redseer analysts also pointed out that the share of Chinese products being sold by online retailers has been decreasing. This is because sellers have to mention the country of origin.

The fashion category is also driving festive growth. This is fuelled by the consumer need for wardrobe improvement.

An estimated Rs 5,500 crore worth of fashion sales were seen during the first four days. Fashion saw a 4.5x jump in terms of daily average GMV compared to normal days.

Redseer said there is a Tier 2+ growth wave driven by the adoption of new commerce and curated offering for targeted customers.

“The festive celebrations were a bit muted last year as well,” said Chaudhry. He added, “But this year, we are seeing strong growth again. This is driven by the fact that people have started going out and they are looking forward to celebrating the season.”

However, despite the growth in sales, the average ticket size of purchases during the first week is estimated to remain similar to last year.

Chaudhry said while the ticket size (per person) is expected to be around Rs 5,400 in the first half of the festive week of 2022, it was in the range of Rs 5,000-5,200 during 2021 and 2020.

Earlier this month, Redseer said e-commerce retailers led by Amazon and Flipkart are expected to garner sales worth $11.8 billion this festive season. This is comfortably more than double the pre-pandemic figure of $5 billion in 2019.

This year’s numbers are projected to increase by 28 per cent from 2021, which saw festive season sales of about $9.2 billion. The spurt in sales will further push the overall online retail GMV up 30 per cent from $52 billion in 2021 to $68 billion this year.

Note:- (Not all news on the site expresses the point of view of the site, but we transmit this news automatically and translate it through programmatic technology on the site and not from a human editor. The content is auto-generated from a syndicated feed.))