New Delhi

CNN

—

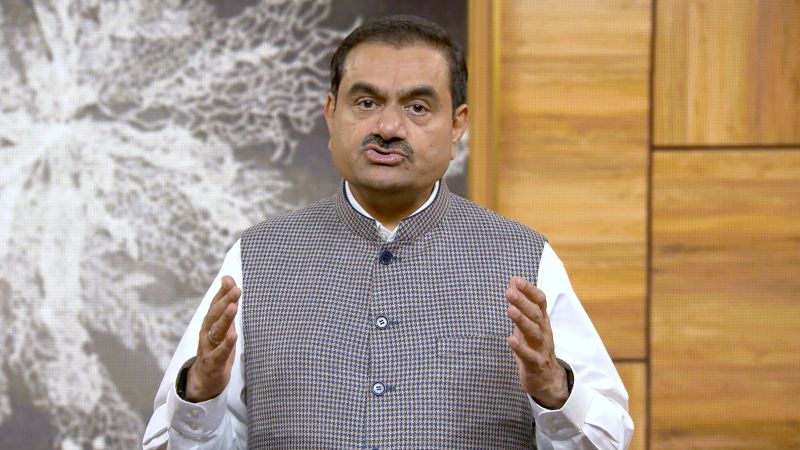

Indian billionaire Gautam Adani tried to reassure investors on Thursday after he abruptly abandoned his flagship firm’s $2.5 billion share sale.

“For me, the interest of my investors is paramount and everything is secondary,” the 60-year-old businessman said in a recorded video address. “Once the market stabilizes, we will review our capital market strategy.”

This was the first time the tycoon has spoken about the stock market mayhem that has wiped billions off his logistics and energy business empire.

A week-long meltdown in the value of Adani Group shares started when an American short seller accused the conglomerate of fraud. The group, which has seven listed companies, has lost more than $90 billion in market value in the week since Hindenburg Research published its report.

Foreign banks have started to closely scrutinize the conglomerate. According to Bloomberg, Credit Suisse has stopped accepting bonds of Adani firms as collateral for margin loans to its private banking clients. The Swiss lender declined to comment on a CNN request for confirmation.

Despite the turmoil, the group’s flagship company, Adani Enterprises, managed to issue new shares worth $2.5 billion on Tuesday. The capital raising exercise was touted as India’s biggest ever public offering by a listed company. After a tepid start, the offer was fully subscribed.

A day later, though, Adani abandoned the deal. The shares have been trading considerably below the offer price since last week, meaning that investors in the capital raise were looking at immediate losses.

“Hence to insulate the investors from potential losses we have withdrawn,” Adani said in the video. “This decision will not have any impact on our existing operations and future plans. We will continue to focus on timely execution and delivery of projects.”

Adani added that his group’s fundamentals were “strong” and that it had an “impeccable track record of fulfilling our debt obligations.”

In an investigation published on January 24, Hindenburg Research accused the Adani Group of “brazen stock manipulation and accounting fraud scheme over the course of decades.”

The research firm also questioned the “sky-high valuations” of Adani firms and said their “substantial debt” put the entire group “on a precarious financial footing.”

While the Adani Group had immediately denounced the report as “baseless” and “malicious,” the video address marked the first time the founder spoke about the crisis.

But it wasn’t enough calm the markets. Shares in Adani Enterprises were down almost 9% in Mumbai, while shares in his other companies plunged 5% to 10%.

Indian market regulators have not yet commented on the events of the past week. But, Reuters reported Wednesday that the Securities and Exchange Board of India (SEBI) was examining the stock price falls and also looking into any possible irregularities in Tuesday’s share sale, citing a source with direct knowledge of the matter.

The scrapping of the share sale on Wednesday was a huge setback for one of India’s most prominent industrialists. Just a week ago, Adani’s sprawling group was worth over $200 billion, making him Asia’s richest man by a wide margin. At one point last year, he even overtook Jeff Bezos to become the second richest person in the world.

On Wednesday, Adani lost his perch as Asia’s richest man, according to the Bloomberg Billionaire’s Index. He had a net worth of $72.1 billion, according to the index, behind Mukesh Ambani, who has a fortune of $81 billion.

CNN’s Mark Thompson contributed to this report.

Note:- (Not all news on the site expresses the point of view of the site, but we transmit this news automatically and translate it through programmatic technology on the site and not from a human editor. The content is auto-generated from a syndicated feed.))

You’ve made some good points there. I checked on the web for additional information about the

issue and found most people will go along with your views on this web site.