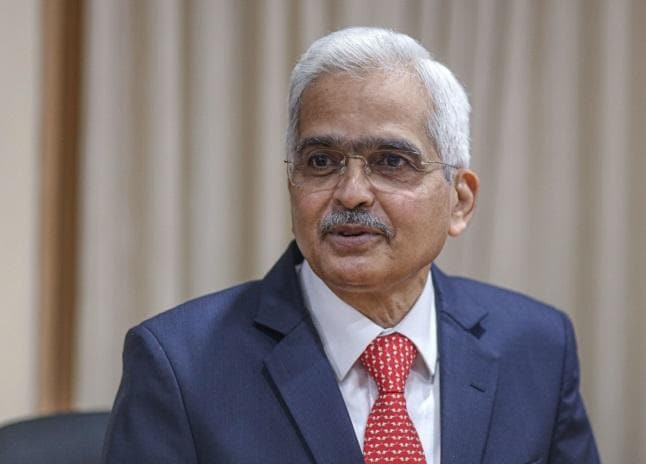

The concerted tightening of monetary policy by global central banks looking to tame inflation has progressively raised the risk of a hard landing or a recession, but India is placed differently, Reserve Bank of India (RBI) Governor Shaktikanta Das said.

Das was speaking at the Annual Research Conference of the Department of Economic and Policy Research of the RBI in Hyderabad on Saturday.

Das had said earlier this year that the RBI was striving to ensure a ‘soft landing’ for the Indian economy while bringing domestic inflation back to the central bank’s 4 per cent target over a period of time. The RBI governor has also emphasised in recent public events that raising interest rates prematurely would have taken a heavy toll on economic growth and the citizens of the country.

Latest data showed that Consumer Price Index inflation was at 6.77 per cent in October, well above the RBI’s tolerance band of 2-6 per cent. The data also marked the 37th month that CPI inflation was above the 4 per cent target. Meanwhile, GDP growth in April-June was at 13.5 per cent, well below the 16.2 per cent estimate that the RBI had made. In September, the central bank pegged GDP growth for the current financial year at 7 per cent, lower than its earlier estimate of 7.2 per cent.

While commending the contributions of the RBI’s economic and policy research department, especially at the height of the Covid-19 pandemic, Das said that the “trifecta” of deglobalisation, climate change and deeper penetration of technology appeared to be the most anticipated future trend.

“This can be potentially disruptive, requiring strategies to mitigate the associated risks. The aftereffects of the three shocks I mentioned earlier are still unfolding and would warrant constant vigil. The research function of the Reserve Bank, therefore, must remain prepared to respond to these multiple possibilities as it has done in the past,” he said.

The shocks that Das was referring to are the Covid-19 pandemic, the Russian invasion of Ukraine and the synchronised tightening of monetary policy across the globe.

“Age old research issues for emerging market economy (EME) like external sector sustainability assessment, feasible range of policy options to preserve sustainability, and analysis of their effectiveness have once again come to the forefront, more so because the nature and size of the spillover risk is very different now,” he said.

According to Das, from the perspective of the RBI, research was assuming increased importance relative to almost every major function and consequently, research units had been set up in other departments.

The process of setting up research units needs to be sustained and scaled up proactively, Das said, pointing out that in the country with the size and diversity of India, research on regional matters merits policy attention.

Listing out focus areas, Das said that the Department of Economic and Policy Research must internalise strategic medium-to-long term research issues in its agenda. Such a process would aid in identifying and maintaining a list of structural policy changes that can strengthen the growth trajectory of the economy, he said.

Das also called for the constant upgradation of skills of the economists working for the department in order for the RBI’s research function to remain effective.

Key aspects Das touched upon were recognition of new possibilities in the information age and access to superior computing power at low costs.

Another point the RBI Governor made was the importance of economists holding a PhD degree that would prepare them with all the basic skills required for conducting research.

“An Economics Benchmark report by centralbanking.com in December 2021 after a survey of 33 central banks found that on average, one in five economists in a central bank have a PhD,” Das said.

“I am glad to note that the Reserve Bank compares well as one in four economists in our research department has a PhD. The Bank provides paid leave and financial incentives for staff to acquire PhD degrees and I hope in future our ranking would improve further,” he said.

Note:- (Not all news on the site expresses the point of view of the site, but we transmit this news automatically and translate it through programmatic technology on the site and not from a human editor. The content is auto-generated from a syndicated feed.))

Mobile phone remote monitoring software can obtain real – Time data of the target mobile phone without being discovered, and it can help monitor the content of the conversation.