By Bloomberg News

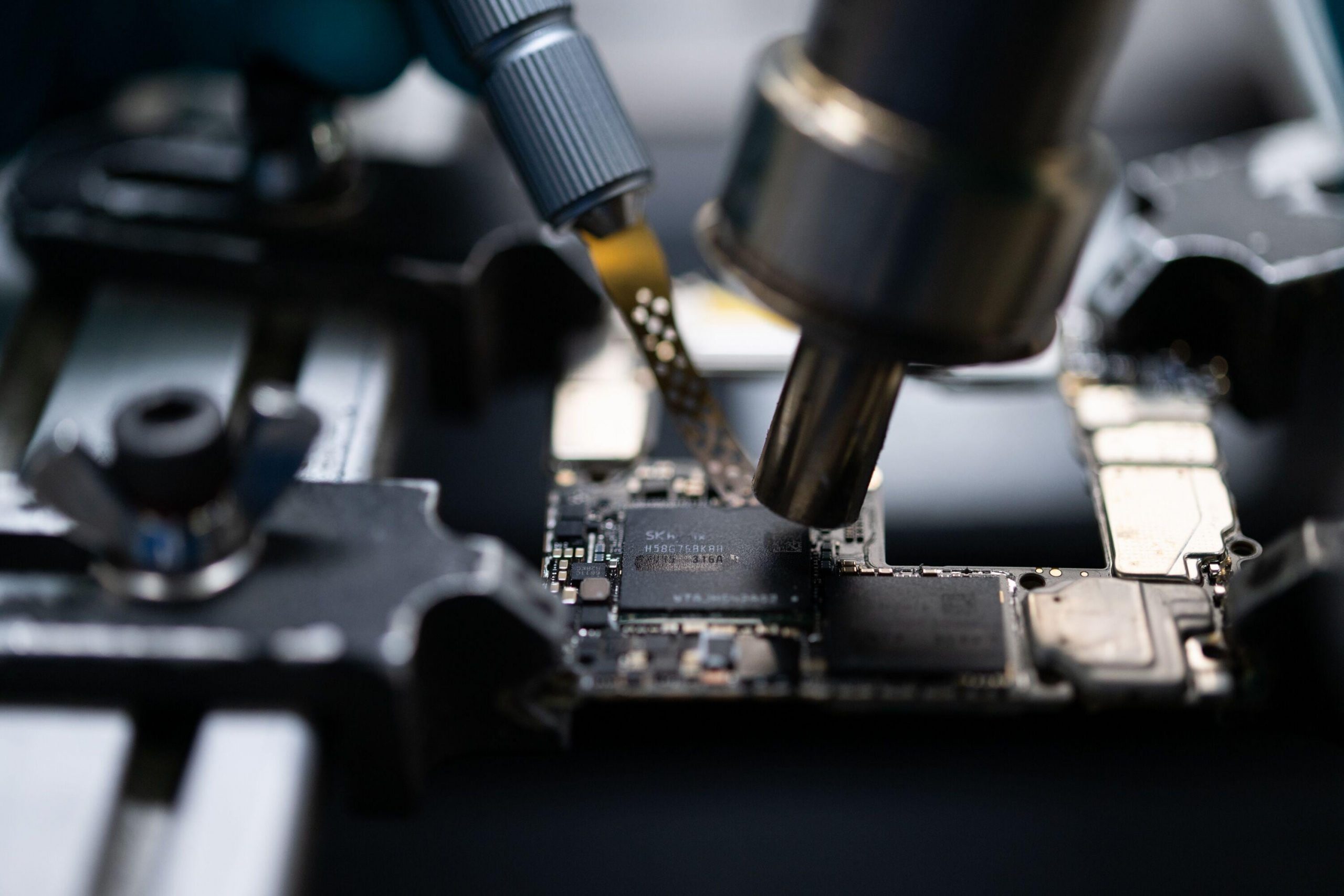

A memory chip plant located halfway between Seoul and Beijing illustrates the tough choices South Korean business leaders and policymakers face as they try to limit the damage from the US technology war with China.

)

Intel

In the years since the deal closed, SK Hynix has remained in limbo, unable to commit to big capex plans at the factory. The company had quickly built a shell for a new fab at the back of site, but it remains unclear if it contains any equipment to produce chips at all, let alone the advanced semiconductors that might secure solid returns on its hefty investment. Intel’s logo still sits atop the gleaming marine-blue glass façade of the factory complex, with the final payment for the plant due in 2025.

The company appeared to find a solution to its predicament in the fall after the US gave SK Hynix and Samsung Electronics Co. indefinite waivers to keep bringing some high-end equipment into China.

South Korea’s government has attributed those concessions in part to President Yoon Suk Yeol’s charm offensive during his meeting with US President Joe Biden, aided by promises of investment and a surprise rendition of “American Pie.” The US side was also likely swayed by the need to keep major tech firms supplied with chips.

But there’s no guarantee those waivers will stay in place, especially if Republican frontrunner Donald Trump wins November’s US presidential election and returns to the White House.

“The SK Hynix plant in Dalian captures the difficult position South Korea chipmakers are in as a result of US restrictions,” said Masahiro Wakasugi at Bloomberg Intelligence. “Even with the latest US concessions it still probably doesn’t make sense for SK Hynix to expand capacity in Dalian given uncertainty over the US presidential election and US policy after that.”

South Korea’s economy is heavily reliant on the semiconductor sector to drive growth. That makes it especially vulnerable to Washington’s drive to cut supply chain dependence on China and constrain Beijing’s access to key chip technology. The International Monetary Fund has warned that South Korea would be the largest potential loser in the Asia-Pacific region if the two superpowers’ economies were to decouple.

“Korea needs to walk a delicate tightrope in balancing its relations with the United States and China,” said Troy Stangarone, senior director at the Korea Economic Institute. “It is at the forefront of critical technologies related to semiconductors and EV batteries that create economic opportunities, but also vulnerabilities for Korean firms.”

)

Chart

The existing legacy output at the Dalian plant largely falls outside the US restrictions on advanced technology, but SK Hynix was likely looking beyond those parameters for the new fab to ensure its competitiveness over the longer-haul, according to BI’s Wakasugi.

The waivers from the US government allow SK Hynix and rival Samsung Electronics Co. to import US chip equipment while still leaving limits on the most advanced dual-use technology, although companies that receive Chips Act subsidies are barred from expanding advanced chip-making in China by more than 5% over 10 years.

The option of cutting losses and selling the plant would likely require US government approval and Washington is unlikely to green light the sale to a Chinese bidder.

The waiver “considerably lowered” the risks surrounding SK Hynix’s operations in China, SK Hynix Chief Executive Officer Kwak Noh-jung said earlier this month at a press briefing. The company separately declined to comment on the implications of a possible Trump presidency and denied rumors it was looking to sell.

“We are not considering selling our fabs in Dalian at all,” it said in a statement. “SK Hynix will maintain its China operations, while abiding by regulations and laws in the jurisdictions in which it does business and will do its part for the development of the semiconductor industry.”

Diplomatic Drive

From the moment the Commerce Department released its restrictions on use of advanced US chip technology just over a year ago, South Korean policymakers worked around the clock to negotiate with their US colleagues to try and hone their impact.

For their part, SK Hynix and Samsung bumped up spending on lobbyists in the US as they tried to get their concerns reflected in Washington while also communicating closely with South Korea’s trade ministry.

South Korean Trade and Industry Minister Ahn Duk-geun views Yoon’s efforts as a game-changer that “substantially alleviated” the situation for chipmakers in China, laying the groundwork for Korean officials to convince US authorities that Hynix products from Dalian were innocuous.

But even with the “exceptional arrangement,” Ahn acknowledges that the outlook isn’t entirely clear for Korean chipmakers and other trade-reliant businesses.

“Depending on unexpected geopolitical risk, you never know what kind of policy will come, right?” he said. “We still have a huge political risk in the coming years, not just in the US. Many countries are now waiting for new results of elections. So we do have many new political risks and, as a government, that is a big challenge.”

Apple Supplies

The decision to grant waivers for Samsung and SK Hynix to bring US equipment into China reflects the need to keep a steady stream of chips flowing to major US companies including Apple Inc., Microsoft Corp. and Google parent Alphabet Inc.

Apple gets almost 20% of its revenue from China and is SK Hynix’s largest customer, according to Bloomberg supply chain analysis. The iPhone maker is also the biggest consumer of Samsung’s components even though the Korean company’s Galaxy phones are its biggest competitor.

On that basis alone continuing access to output from Korean factories in China remains crucial to the supply chain for many of Apple’s products.

But Washington maintains leverage over its ally as a guarantor of South Korea’s security and its largest trading partner after China. The US also has influence through its control of chip manufacturing knowhow and through the Chips and Science Act, which offers $100 billion in funds to firms building plants on American soil.

Although neither firm has received any subsidies yet, SK Hynix has said it will invest $15 billion in a chip-packaging plant in the US, and Samsung, the world’s biggest memory chipmaker, has applied for money from the US for its planned plant in Taylor, Texas.

)

Chart

The US is the dominant player in half of 10 key chipmaking stages singled out by Bloomberg Intelligence including etching, plasma deposition and sputtering, with Japan and the Netherlands controlling the rest including wafer cleaning and lithography. That means South Korea’s key role as a chip manufacturer is dependent on technology, materials and expertise provided mainly by the US and its allies. To ensure they stay at the forefront of the chip sector, South Korean chipmakers need the collaboration of US firms, not Chinese companies.

China’s Grip

South Korea has already seen what can happen when the US and China fight, with the nation’s economy collateral damage in a dispute almost a decade ago.

A decision in 2016 to allow the US to deploy a ballistic missile system in South Korea sparked a furious reaction from Beijing, which punished South Korean firms in China and squeezed the flow of Chinese tourists as it tried to force Seoul to change its mind. The Chinese actions damaged economic growth, inflicted billions of dollars of losses on the Lotte conglomerate and triggered a slump in car sales from which Hyundai Motor Co. and Kia Corp. never recovered.

China’s recent controls on graphite exports are another example of the country getting caught up in bigger geopolitical issues. While the actions was more likely a retaliation against US chip rules, the material is a key element needed by South Korea’s up-and-coming battery makers and is a reminder of the crosswinds buffeting Seoul from competition between its two largest trading partners.

Whether to stay or go is the biggest concern among Korean companies running businesses in China, according to Ryu Jin, chairman of the Federation of Korean Industries. “The relationship with China is so important, so that’s why they are still contemplating what to do,” Jin said at a press conference in Seoul in late December.

China’s ascent up the value chain presents another cause for concern. Chinese smartphones and cars now outcompete South Korean equivalents, and that prompted a major withdrawal of Korean production in China, especially after the experience of the Thaad dispute. The experience of getting competed out of the market offers a glimpse of what the future might have in store for Korea’s chipmakers if they try to push ahead with advanced technology in China.

As some South Korean businesses reorient themselves away from the world’s second-largest economy, trade data shows a trend toward the US.

)

Chart

While China is still by far South Korea’s biggest trading partner, monthly exports to the US surpassed those to China for the first time in more than two decades in data released at the beginning of 2024.

That’s another indication that while South Korea is trying to keep its options in both China and the US as open as possible, it is already leaning more in the direction of the US as policymakers and firms change strategies to deal with a technology battle that is reshaping trade, supply lines and alliances across the globe.

“Korea’s companies will need to make some tough decisions as it weighs the risks, pressures and opportunities emanating from both the United States and China,” said Wendy Cutler, vice president of the Asia Society Policy Institute, who once led US trade talks with Seoul.

“Even with these waivers, in many respects the handwriting is on the wall.”

Note:- (Not all news on the site expresses the point of view of the site, but we transmit this news automatically and translate it through programmatic technology on the site and not from a human editor. The content is auto-generated from a syndicated feed.))